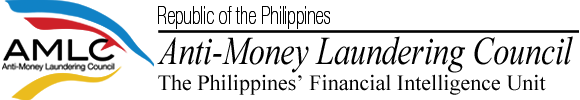

In a formal ceremony today at the Century Park Hotel Manila, the respective heads and key officials of the Anti-Money Laundering Council (AMLC), Philippine Amusement and Gaming Corporation (PAGCOR), Cagayan Export Zone Authority (CEZA) and Aurora Pacific Economic Zone and Freeport (APECO) jointly signed the newly-adopted Casino Implementing Rules and Regulations (CIRRs) of Republic Act (RA) No. 10927, which amended the Anti-Money Laundering Act of 2001 (AMLA).

|

| SIGNING OF AMLA RULES FOR CASINOS. AMLC Chairman and BSP Governor Nestor A. Espenilla, Jr. (center), leads the signing of the Casino Implementing Rules and Regulations at the Century Park Hotel Manila, on October 25. From left to right: Directors Milton A. Alingod, Arturo P. Bautista, and Secretary Raul I. Lambino, all of CEZA; Insurance Commissioner Dennis B. Funa; SEC Chairperson Teresita J. Herbosa; PAGCOR Chairperson and CEO Andrea D. Domingo; PAGCOR President and COO Alfredo C. Lim; PAGCOR Directors Gabriel S. Claudio and Reynaldo E. Concordia; and APECO President and CEO Israel F. Maducdoc. |

Gracing the occasion were AMLC officials led by Bangko Sentral ng Pilipinas (BSP) Governor and AMLC Chairman Nestor A. Espenilla, Jr., Chairperson Teresita J. Herbosa of the Securities and Exchange Commission (SEC), and Commissioner Dennis B. Funa of the Insurance Commission. Andrea D. Domingo, Chairman and Chief Executive Officer of PAGCOR; Director Arturo P. Bautista of CEZA and Israel F. Maducdoc of APECO led the officials of their respective regulatory agencies. Representing the AMLC Secretariat was Executive Director Mel Georgie B. Racela.

The casino law, as RA No. 10927 is popularly known, included casinos within the ambit of the AMLA, and requires casinos to identify and conduct due diligence on customers, keep records of transactions, and submit covered and suspicious transaction reports to the AMLC. Just like banks, insurance companies and securities dealers, casinos' compliance with the CIRRs will now be monitored by PAGCOR, CEZA and APECO with respect to their licensees and any such noted violations may be further referred to the AMLC.

As early as 2008, in the mutual evaluation of the Philippines, the Asia Pacific Group (APG) of Financial Intelligence Units (FIUs) found the country’s anti-money laundering policy deficient for the failure to include casinos within the AMLA. The AMLC had lobbied intensely since then for the coverage of casinos under the AMLA.

In his opening remarks, BSP Governor and AMLC Chairman Espenilla noted that enactment of the casino law and adoption of the CIRRs addressed deficiencies in the Philippines’ anti-money laundering regime, which until then, did not include casinos in the AMLA’s coverage. He also called for cooperation and partnership between the AMLC and the three casino regulators to counter money laundering and financing of terrorism.

PAGCOR Chairman Domingo, meanwhile, welcomed the adoption of the CIRRs as a continuation of PAGCOR’s efforts to match anti-money laundering rules in developed regions of the world. According to her, PAGCOR had already adopted customer due diligence and suspicious activity monitoring. However, she also emphasized the need for self-regulation among casinos and gaming operators. Notably, PAGCOR not only regulates but also operates casinos.

The basic framework, preparation and discussions of the draft rules, and technical training and formal signing were organized through the assistance of David Binns, head of the Asian Development Bank’s Office of Anticorruption and Integrity, and Atty. Jose Luis C. Syquia, Chief of the Due Diligence Unit of the same office.