|

PHILIPPINES' CONTINUED EFFORTS IN STRENGTHENING AML/CTF/CPF REGIME IN RESPONSE TO FATF STATEMENT In response to the Financial Action Task Force (FATF) public statement on October 27, 2023, we highlight that the Government of the Philippines had reaffirmed its steadfast commitment to bolstering the effectiveness of its Anti-Money Laundering, Counter Terrorism Financing and Counter Proliferation Financing (AML/CTF/CPF) regime. |

|

AMLC STATEMENT ON THE LANDMARK JUDGMENT OF THE RTC, BRANCH 295, PARAÑAQUE CITY, ORDERING THE CRIMINAL FORFEITURE OF DRUG PROCEEDS In a Decision rendered by the Regional Trial Court (RTC) of Parañaque City, Branch 295, promulgated on 29 April 2022, the court convicted Wang Li Na, a Chinese national, of money laundering for purchasing a condominium unit in Marina Bay Homes, Parañaque City, using funds generated through her and her husband’s illegal drug trafficking activity. The said decision is the first time in the Philippines where a court ordered the forfeiture of a property in a criminal case pursuant to the Rule on Criminal Forfeiture in Money Laundering Cases (A.M. No. 21-03-13-SC). Wang Li Na and her husband Li Lan Yan, a.k.a. Jackson Dy, were previously convicted on 29 April 2009 by the RTC-Parañaque City, Branch 274, for illegal possession of 350.67 kilograms of methamphetamine hydrochloride (shabu). The said illegal drugs were recovered by the Philippine National Police Anti-Illegal Drugs Special Operations Task Force (PNP-AIDSOTF) by virtue of a search warrant implemented at a house in the name of the convicted spouses in Marina Bay Homes, Parañaque City. Li Lan Yan and his cohorts are also facing criminal charges before the RTC-Trece Martires City for illegal manufacture of dangerous drugs in a clandestine shabu laboratory located in Tanza, Cavite. The RTC-Trece Martires City, in a decision dated 4 November 2016, ordered the forfeiture of the shabu laboratory and its premises in favor of the Philippine Government in a separate civil forfeiture case. The RTC’s judgment against Wang Li Na serves as a warning to all would-be money launderers that the properties that they acquire through crimes may be forfeited by the Philippine Government. Posted 23 June 2023 |

|

Reminder to Update Covered Person Information Via ORS The AMLC urges covered persons to update their registration through the Online Registration System (ORS). |

|

Declaration of Localized Non-Reporting Day on Areas Severely Affected by Typhoon Odette As the AMLC recognizes the significant impact of Typhoon Odette on business operations due to damages on power supply lines and communication lines, including internet connectivity, please be advised of the following: |

|

NOTICE OF NATIONAL ANTI-MONEY LAUNDERING/COUNTERING THE FINANCING OF TERRORISM COORDINATING COMMITTEE ADVISORY ON THE PROPER APPLICATION OF THE RISK-BASED APPROACH ON FILIPINOS FOLLOWING THE INCLUSION OF THE PHILIPPINES IN THE FATF’S GREY LIST

|

|

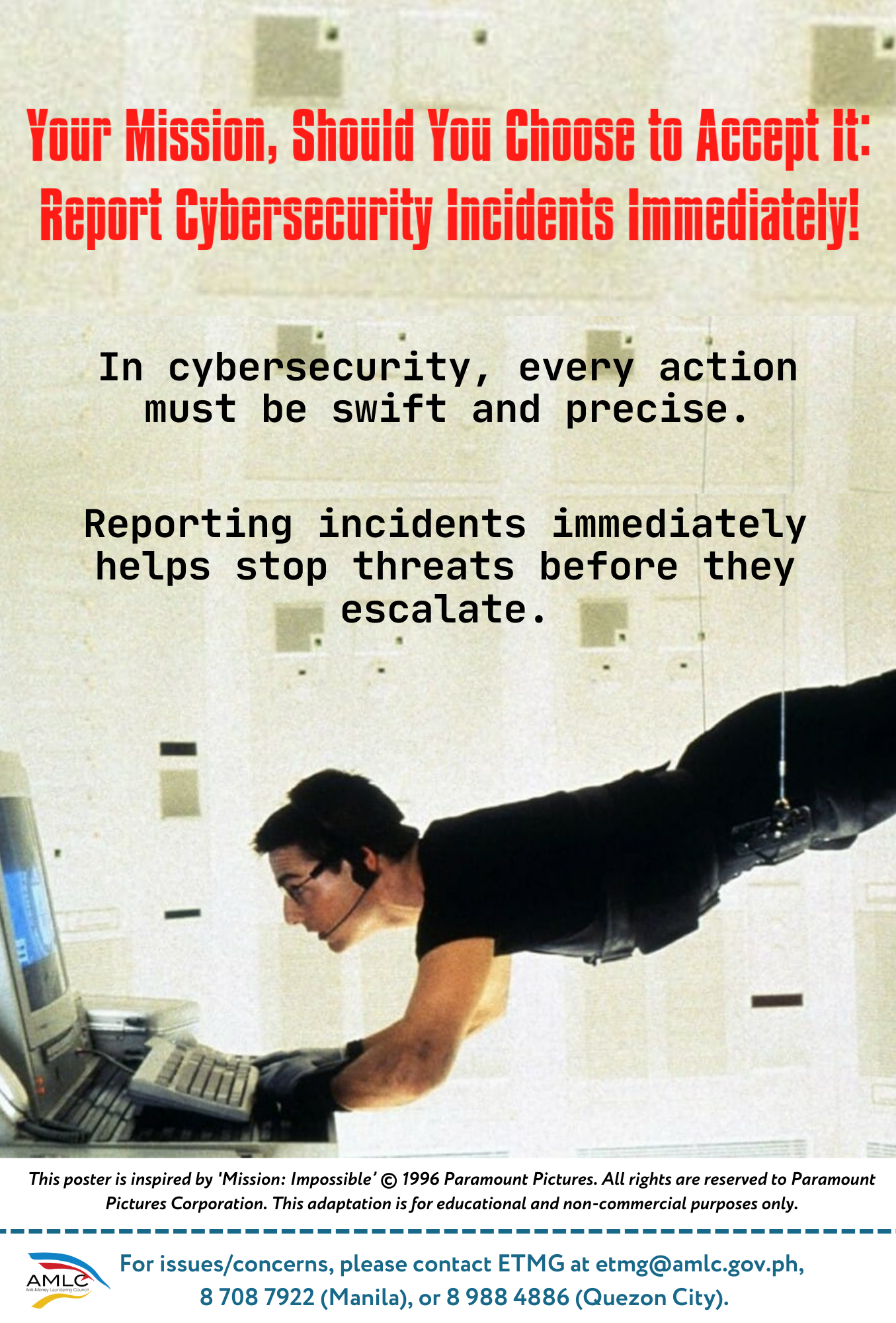

PUBLIC ADVISORY ON FRAUDULENT E-MAILS USING THE @AMLC.GOV.PH DOMAIN The scammers send emails to potential victims, using these e-mail addresses, requesting them to pay a certain amount of money in order for the AMLC, or its Secretariat, to facilitate some sort of service, which appears to be beneficial to the victims. The AMLC Secretariat reiterates that the Anti-Money Laundering Act of 2001 (Republic Act No. 9160), as amended, the law that created the AMLC, does not grant it any power or authority to request any kind of payment or fee from the public in exchange for its services. Specifically, the AMLC, or its Secretariat, does not require any person to post a bond or payment as a prerequisite for the issuance of any type of Certification or the execution of any of its functions. Kindly disregard any communication from any person that may be posing as a member of the AMLC or its Secretariat. The public is advised to report such fraudulent activities to the appropriate law enforcement agencies. Any issues or concerns on the legitimacy of an e-mail, purportedly sent by the AMLC, its Members, its Secretariat or any of its officers and personnel, can either be e-mailed to the official AMLC Secretariat e-mail address at This email address is being protected from spambots. You need JavaScript enabled to view it. or mailed to the AMLC Secretariat, 5/F EDPC Building, Bangko Sentral ng Pilipinas Complex, Mabini corner Vito Cruz Streets, Malate, Manila, Philippines. All replies of the AMLC Secretariat will also be sent through these official channels.

|

|

PUBLIC ADVISORY ON FRAUDULENT LETTERS OF GUARANTEES AND FACILITATION OF FUND TRANSFERS AND HOLD ON TAXES The Anti-Money Laundering Council (AMLC) Secretariat has noted the inquiries it has received, both from the Philippines and abroad, on the authenticity of certain emails and letters, in which scammers pose as Members of the AMLC, or officers and personnel of the AMLC Secretariat. Typically, these scammers send emails or letters informing the potential victim to pay a certain amount of money (which they call “tax clearance”, “facilitation fee” or other similar terms) for him to receive an amount many times larger than this payment, supposedly “to release the hold on the funds” or “to guarantee safe and secure transfer of funds” to the victim’s account. The scammers require the potential victim to deposit the “payment” to the scammers’ bank account, and disclose his bank account. Once the victim remits the “payment” to the scammers, the scammers cut off any communications with him, and the promised release of funds never materialize. The public is hereby informed that Republic Act No. 9160 or the Anti-Money Laundering Act of 2001, the law that created the AMLC, does not grant the AMLC any function or authority to hold an account for tax purposes, guarantee safe and secure transfer of funds or oversee economic transactions, or to engage in commercial transactions. Thus, the AMLC and its Members, as well as the AMLC Secretariat or any of its personnel, do not, and will never, contact the public for payment of any sum of money or disclose details of bank accounts. Any email or letter purportedly sent by the AMLC or any of its Members, and its Secretariat, or any officer or employee thereof cannot be genuine or authorized by the AMLC. The public is therefore warned to ignore emails, letters, and other documents of this tenor, as these are fraudulent. The AMLC further advises the public to report these fraudulent activities to the appropriate law enforcement agencies. If you have been victimized by scammers or have encountered or received fraudulent emails or letters, or information on scams of the above tenor or similar deceptive schemes devised by persons identifying themselves with the AMLC or its Secretariat, please e-mail the AMLC Secretariat at This email address is being protected from spambots. You need JavaScript enabled to view it..

|

| To View AMLC AGUID 18-01: "Lend-Out"/ Dummy Accounts: Click this Link |

|

NEW AMLC RULES ON BENEFICIAL OWNERSHIP INTENDED FOR FINANCIAL TRANSPARENCY To promote financial transparency, the Anti-Money Laundering Council (AMLC) has issued for the first time guidelines on beneficial ownership for all banks, insurance companies, and other covered persons. Covered persons include entities, businesses, casinos and professions subject to the authority and jurisdiction of the AMLC on anti-money laundering and counter-terrorism financing (AML/CFT) matters. “Beneficial owners” refers to those individuals or natural persons who ultimately own or control the customer, or those for whom another person conducts a transaction. Money launderers and terrorists routinely use the cloak of anonymity to prevent the AMLC and law enforcement agencies (LEAs) to track them down. In the case of the AMLC, they also seek to avoid freezing and forfeiture of their assets obtained through criminal activities. In many well-publicized cases, criminal elements and a number of high-ranking public figures have used dummies, including non-governmental organizations (NGOs), and individuals, to hide their identities. These criminals then use these dummies to conduct multiple financial transactions involving multiple accounts in the millions of pesos, thereby blurring the illegal source of the funds. In response to these criminal activities, and to prevent future circumvention of the Anti-Money Laundering Act of 2001 (AMLA) and its implementing rules, the AMLC issued the Guidelines on Beneficial Ownership. Issuance of these Guidelines was also intended to bring the Philippines more at par with international financial standards on customer due diligence (CDD). These standards require banks, other financial institutions and certain professions to identify not only the customer with whom they transact, but also the beneficial owners. Although Philippine standards on beneficial ownership as provided under the AMLA’s implementing rules and regulations, were rated medium-high in the 2017 National Risk Assessment, the AMLC perceived the need to adopt the new Guidelines to enhance these standards and guide covered persons in identifying beneficial ownership. The Guidelines provide that covered persons must identify beneficial owners. Covered persons must conduct the risks posed by the customer and the beneficial owners. If they pose a high risk for money laundering or terrorism financing, validation of information must be performed by the covered person. The Guidelines therefore promote transparency and dissuade criminal elements, and would-be money launderers and terrorists from hiding their identities. The Guidelines were published on 27 November 2018 at Business World, and took effect on the same day.

To view the Guidelines, click this link. |

|

ADVISORY ON A FRAUDULENT LETTER OF OBLIGATION 16 December 2015 A certain "Letter of Obligation" allegedly issued by the Anti-Money Laundering Council (AMLC) Secretariat to a certain Iver Pehrson has come to the attention of the AMLC Secretariat. Please be advised that the said Letter of Obligation is a bogus document. Neither the AMLC nor its Secretariat issues any kind of such document. The details (names, letterhead and signatures thereon) are falsified and obviously downloaded from the BSP website. The public is hereby CAUTIONED in transacting with Atty. Joseph Charles Adams & Patterson Law Firm, and any associates or agents of the foregoing, in relation to the claims in the Letter of Obligation. |

|

ADVISORY ON A SPURIOUS LETTER OF GUARANTEE 04 September 2013 The Anti-Money Laundering Council (AMLC) Secretariat received a request for the verification of a "Letter of Release Guarantee" purportedly issued by the AMLC upon the application of a certain Mr. Mickey Cozier, Officer of Investigation, Investment Assurance Corporation(with email address:This email address is being protected from spambots. You need JavaScript enabled to view it./www.iacinternational.org). |

| SEC ADVISORY | |

| 15 November 2015 | |

| 21 October 2015 | |

| 28 September 2015 | |

|

28 September 2015 |

|

| 22 February 2013 | |

| 23 November 2012 | |

| 12 August 2012 |

| BSP ADVISORY | |

| BSP Warns the Public on Fake Bangko Sentral ng Pilipinas (BSP) Documents | 8 September 2015 |

| BSP Warns the Public Against "Phishing Scams" | 8 June 2015 |

| BSP Warns the Public on Text Scams | 13 May 2015 |

| Warning Advisory on Virtual Currencies | 6 March 2014 |

| Beware of Fraudulent Commercial Documents | 28 August 2009 |

REVISED 2 3.jpg)

2024 (First Edition)

2024 (First Edition)