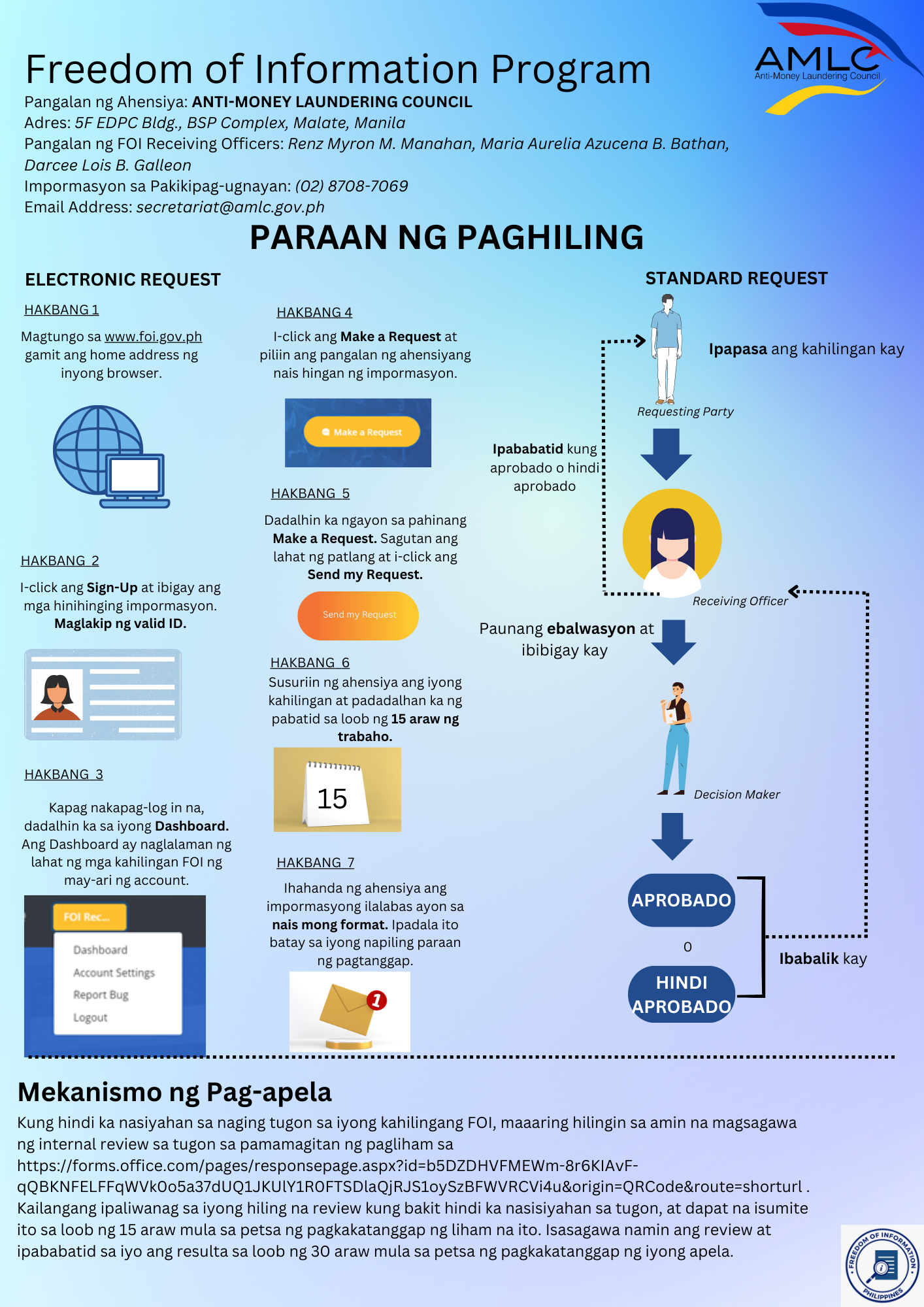

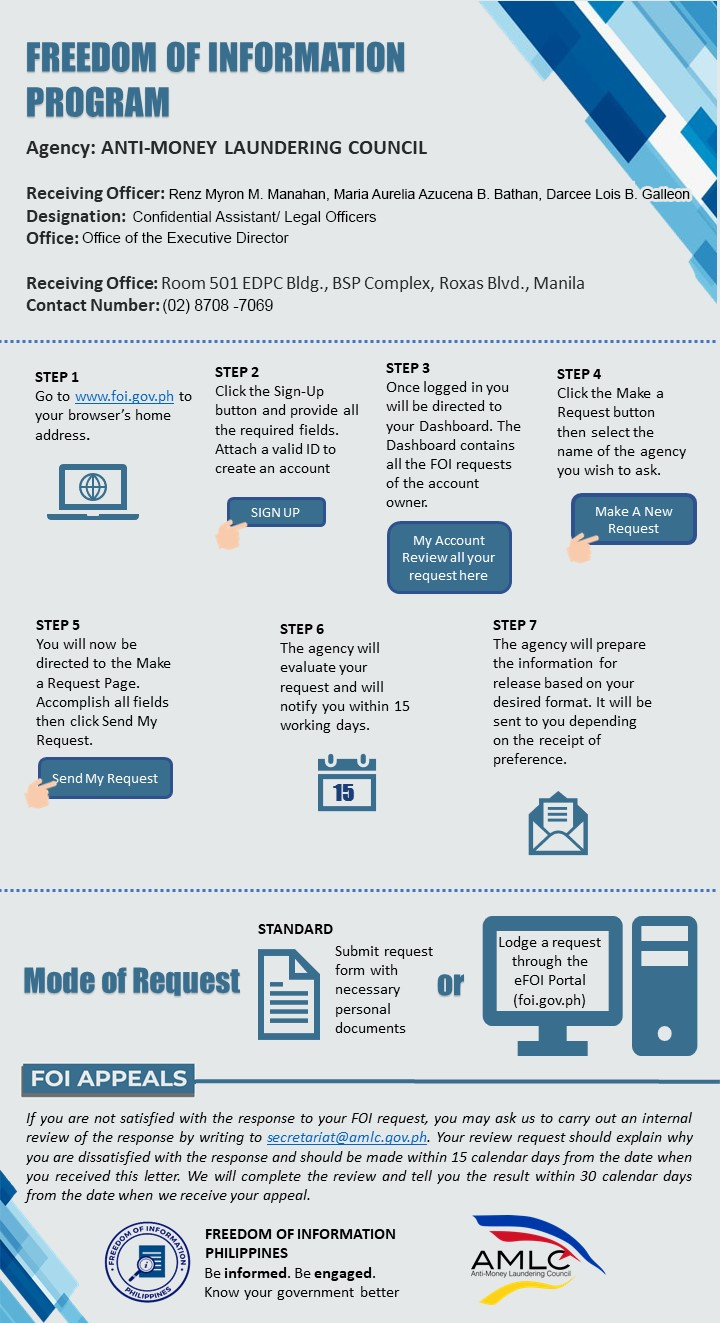

For details, please click this link.

Please click this link for details.

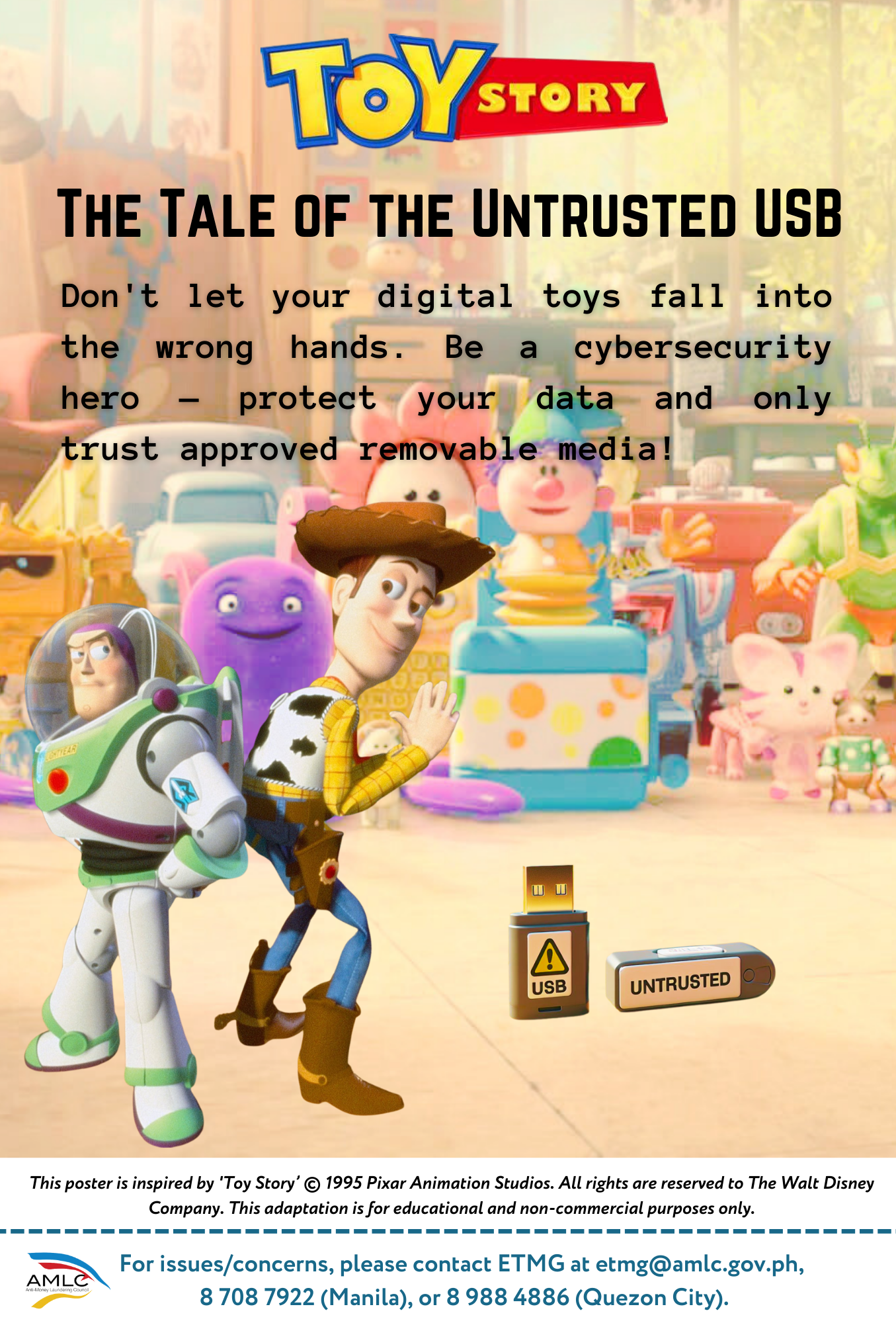

Please be advised that we will be conducting Emergency System Maintenance on AMLC Portal today, March 26, 2025, from 12:00 PM to 1:00 PM to ensure the continued security and performance.

During this period, access to the AMLC Portal will be temporarily unavailable.

Should you have any queries, please contact our Enterprise Technology Management Group (ETMG) at 8708-7923 (Manila) or 8988-4886 (QC).

AMLC Resolution No. 81 dated 09 May 2019 directed the issuance of an advisory to covered persons (CPs) dealing with clients who are classified under the sector of Designated Non-Financial Businesses and Professions (DNFBPs) to demand presentation of their Certificate of Registration (COR) or Provisional COR (PCOR) with the AMLC as part of Customer Due Diligence (CDD) measures under Section 3.5(b)(1) of the 2018 Implementing Rules and Regulations of the AMLA, as amended. Failure of a DNFBP to supply its P/COR is a ground to conduct enhanced due diligence measure (EDD) and/or to re-evaluate the business relationship. On the part of the CP failing to comply with this directive, it may be cited for the applicable administrative sanctions under the Rules of Procedure in Administrative Cases (RPAC).

All CPs must deal only with registered DNFBPs with valid or subsisting P/COR or may risk being cited for a Serious Violation under Section 2(C)(25), Rule IV, of the RPAC.

The updated list of Registered DNFBPs as of 28 February 2025 is posted at Registered DNFBPs.

For the names of newly registered DNFBPs not yet included in the list, CPs may contact for confirmation/validation the Registration Staff of the Compliance and Supervision Group, Detection and Prevention Department, at telephone numbers (632) 5302-3848, 5310-3244, 8708-7067.

Posted on April 4, 2025

REVISED 2 3.jpg)

2024 (First Edition)

2024 (First Edition)