This serves as an updated advisory regarding the Re-registration of covered persons (CPs) under the Compliance Optimization and Registration System (CORS). The re-registration must be completed on or before 29 April 2025, and the forthcoming implementation of Chapter II, Part 1, Items 1.18 & 1.19 in the Guidelines on Transaction Reporting and Compliance Submission (GoTRACS) is on 01 May 2025. For details, please click this link.

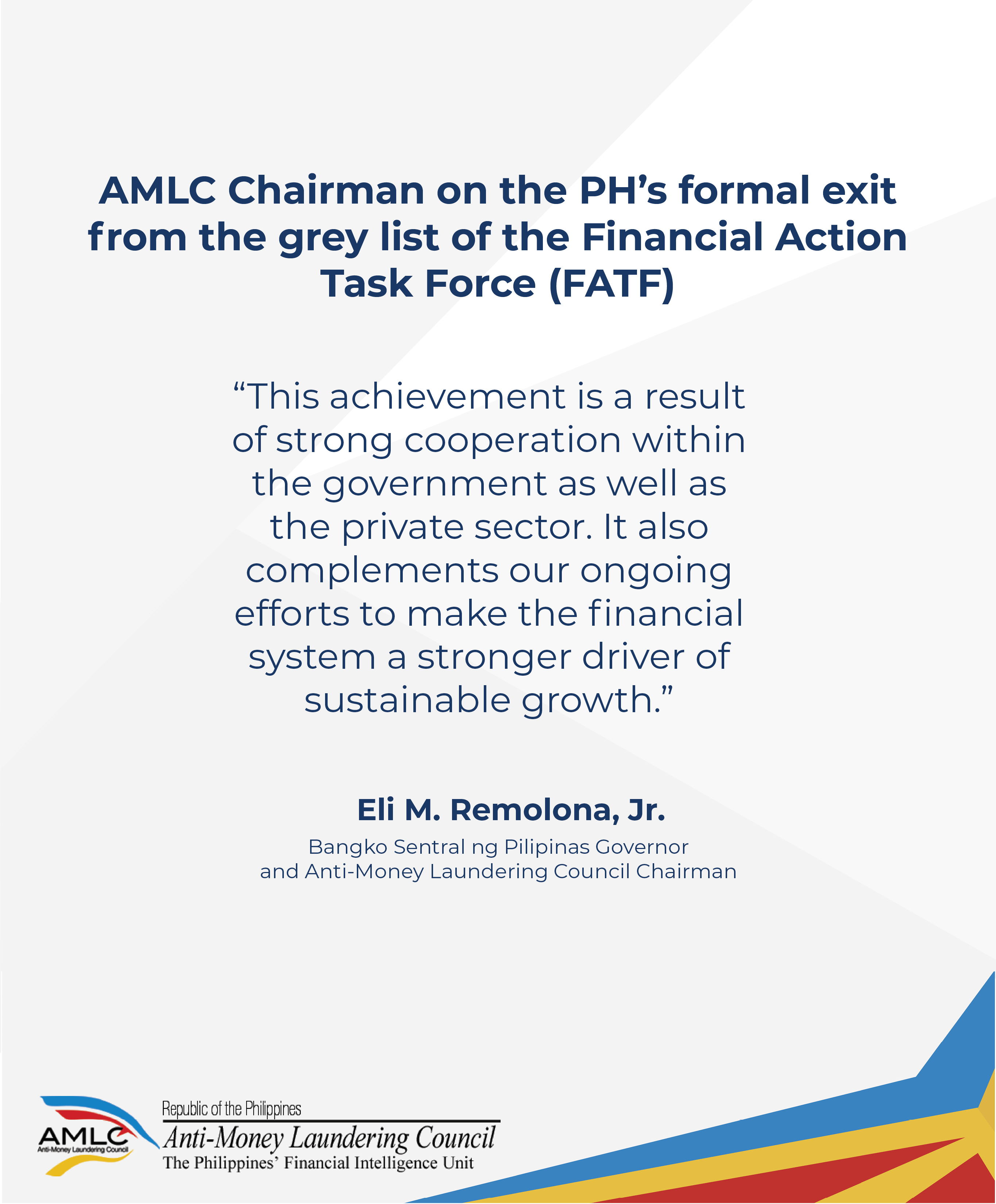

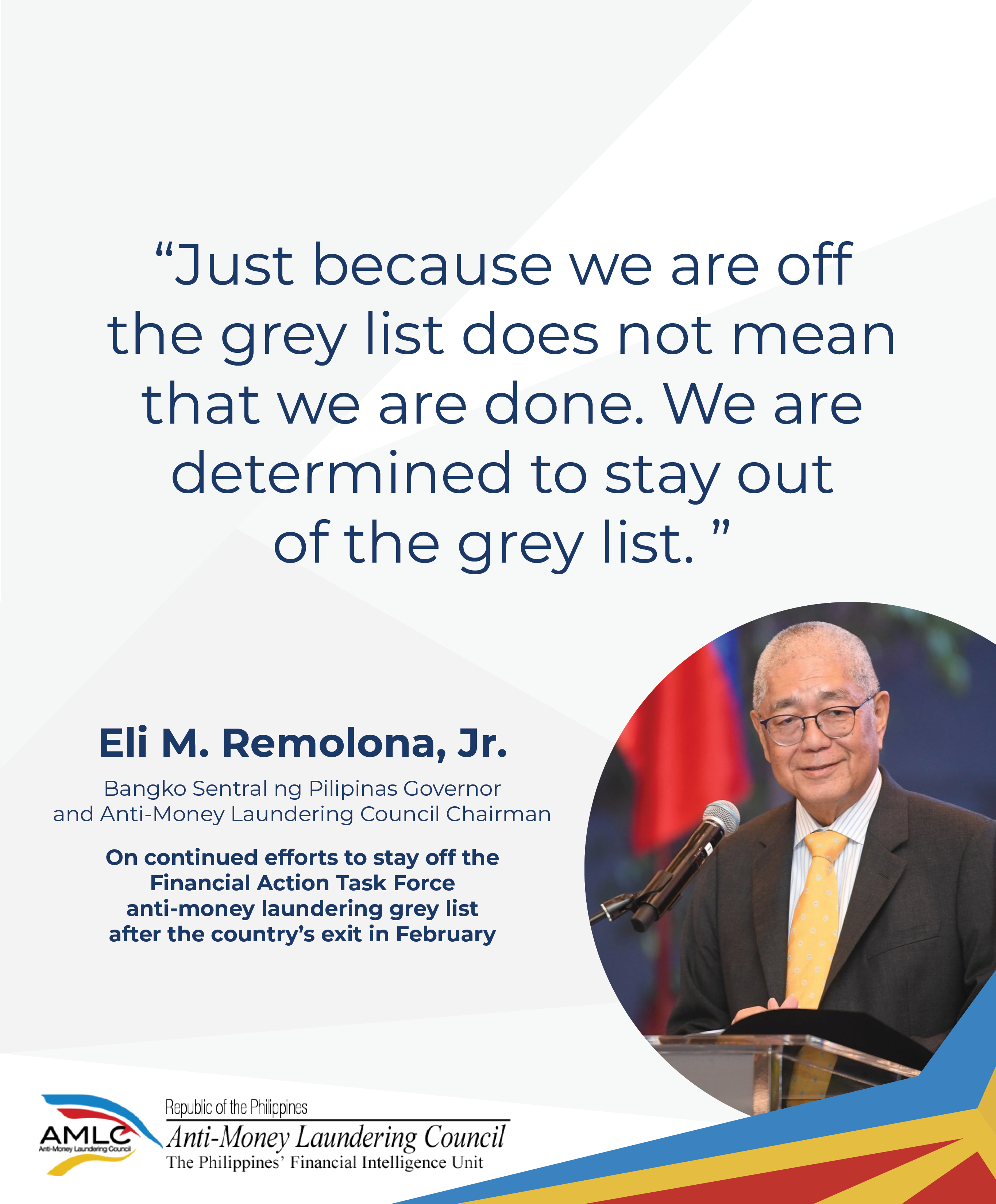

Bangko Sentral ng Pilipinas Governor and Anti-Money Laundering Council Chairman Eli M. Remolona, Jr. highlighted that the Philippines’ exit from the Financial Action Task Force (FATF) grey list renews investor confidence, restores correspondent banking relationships, and helps overseas Filipino workers.

Watch Governor Remolona speak on the delisting of the Philippines from the FATF grey list of countries under increased monitoring.

REVISED 2 3.jpg)

2024 (First Edition)

2024 (First Edition)