News And Announcements

An Analysis of the Usefulnessof Foreign CurrencyDeclarations in Detecting Possible Cross-Border Transportation of Illicit Funds

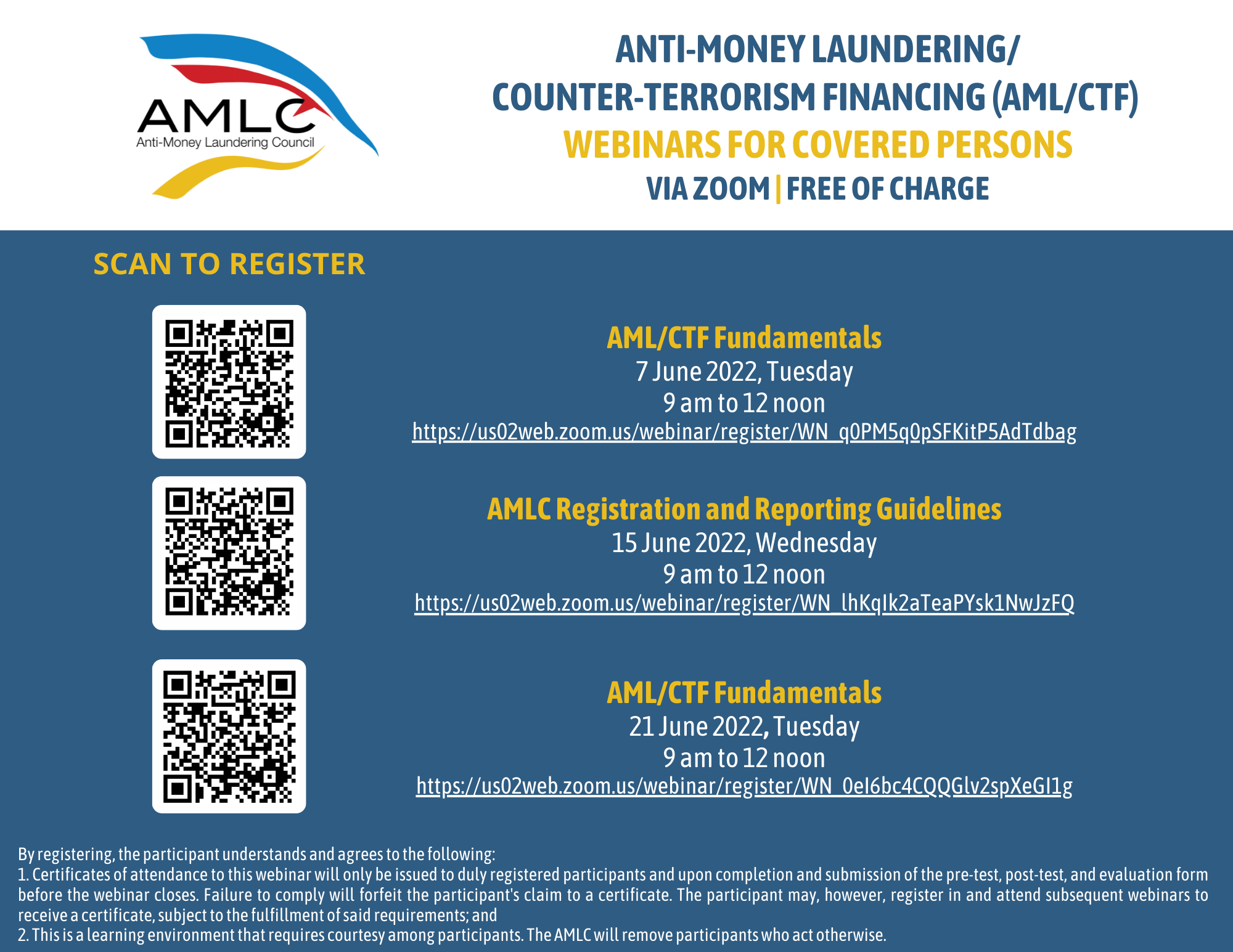

For more details, click this link.

2021 Jan Amendments to the 2018 Implementing Rules and Regulations of Republic Act No. 9160, as Amended.

To download, please click the link.

REVISED 2 3.jpg)

2024 (First Edition)

2024 (First Edition)