ADVISORY: Temporary Power Shutdown

Please be informed that the Anti-Money Laundering Council will perform a temporary power shutdown in relation with the Bangko Sentral ng Pilipinas’s power system maintenance, scheduled from 8:00 PM on Friday, 15 November 2024, to 10:00 PM on Sunday, 17 November 2024. During these periods, access to the AMLC Website and AMLC Portal will be temporarily unavailable.

Should you have any queries, please contact our Enterprise Technology Management Group (ETMG) at 8708-7923 (Manila) or 8988-4886 (QC).

ADVISORY: Declaration of 23-25 October 2024 as Non-Reporting Days

Pursuant to Item V-B (1), Part 1 of the 2021 AMLC Registration and Reporting Guidelines (ARRG), 23-25 October 2024 are declared as non-reporting days and excluded in the counting of the prescribed reporting period.

Should you have any queries, you may refer to the ARRG Hotlines posted on the AMLC Website.

#####

Posted: 05 November 2024

ADVISORY: AMLC REGISTRATION AND REPORTING

Please be informed that the Data Collection and Management Unit (DCMU), which handles the AMLC Registration and Reporting, will be temporarily unreachable through its usual landline numbers.

From 11-15 November 2024, the DCMU may be reached via the following ARRG Hotline Numbers:

|

DAY |

8 AM to 5 PM |

|

Mondays |

0969 052 5224 0967 031 2614 0962 554 7404 |

|

Tuesdays |

0995 163 5724 0969 174 9630 0967 031 2612 0962 894 4519 |

|

Wednesdays |

0967 031 2614 0962 554 7404 0962 894 4519 |

|

Thursdays |

0969 174 9630 0962 554 7407 0967 031 2612 |

|

Fridays |

0962 554 7407 0995 163 5724 0969 052 5224 |

We apologize for any inconvenience this may cause and appreciate your understanding and cooperation.

Thank you.

Posted at www.amlc.gov.ph on

08 November 2024

REVISED 2 3.jpg)

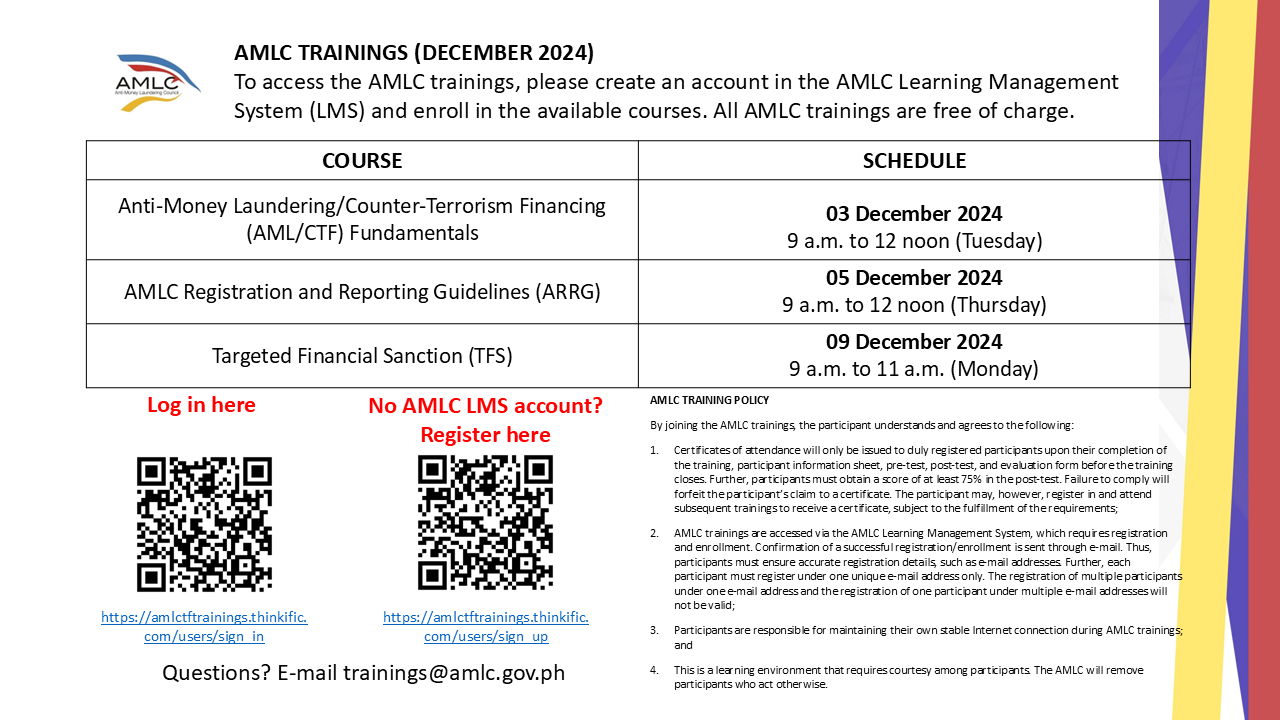

2024 (First Edition)

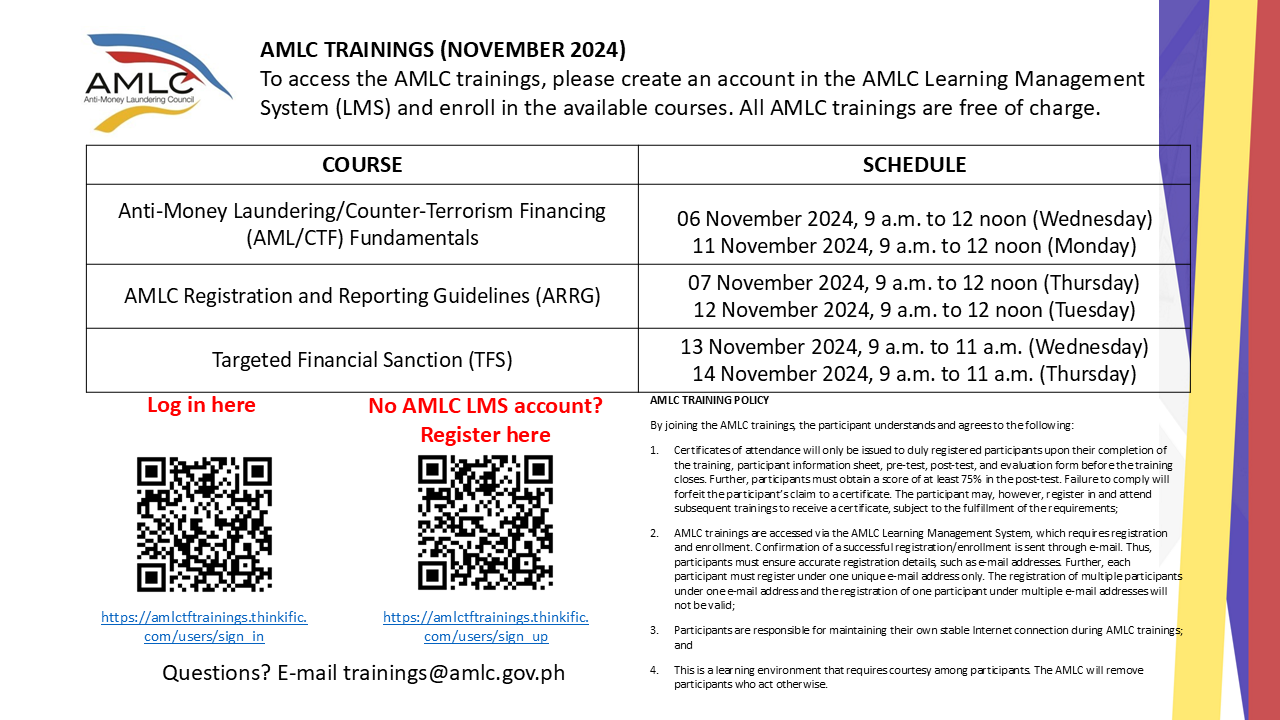

2024 (First Edition)